How to Properly Issue a 1099: A Practical Guide for 2025

Issuing a 1099 can be a critical task for businesses that hire freelancers, contractors, and other vendors. Understanding the 1099 reporting requirements is vital to ensuring compliance with the IRS. This guide will cover everything you need to know about how to issue a 1099, including important deadlines, different types of 1099 forms, and best practices for filling out and submitting these documents.

Understanding 1099 Forms

The first step in the 1099 filing guide is to understand the different types of 1099 forms. These forms are essential for reporting various types of income other than wages, salaries, or tips. The most common forms include the 1099-NEC for independent contractors and the 1099-MISC for various other payments. Depending on services or payments, other forms such as the 1099-R for retirement distributions, 1099-S for sales of real estate, and 1099-Q for qualified educational distributions may also be applicable.

Types of 1099 Forms

Each type of 1099 form serves a specific purpose. For example, the 1099-NEC is specifically for reporting payments to independent contractors, freelancers, and service providers. If you are paying for rent or other miscellaneous payments, you may need to use the 1099-MISC. The 1099-R is used for reporting distributions from retirement plans, while the 1099-DIV reports dividends and distributions to shareholders. Understanding which form to use is crucial to avoid 1099 filing penalties and errors.

Who Needs a 1099?

Knowing who needs a 1099 is fundamental for compliance and accurate record-keeping. Generally, businesses must issue a 1099 form for any individual or entity paid $600 or more in a calendar year for services provided. This applies not only to independent contractors but also to payments for rents, prizes, awards, or other services above the threshold. However, payments made to corporations typically do not require a 1099. Understanding these requirements can help you avoid complications down the line.

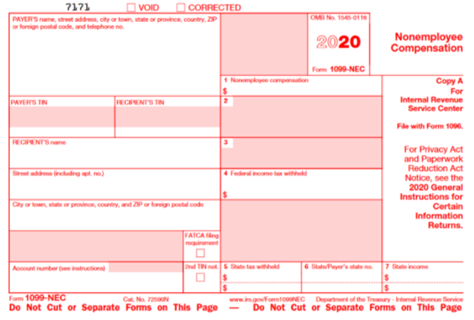

Filling Out the 1099 Form

Filling out a 1099 form accurately is crucial in order to meet IRS requirements. Each 1099 form example has specific fields to complete, which typically include the payer’s and recipient’s information, the amount paid, and the type of service provided. Furthermore, using any accounting software can streamline the 1099 issuing process significantly.

How to Fill Out a 1099 Form

To fill out a 1099 form, begin by entering your name, address, and taxpayer ID on the first section. In the next section, include the recipient’s name, address, and taxpayer identification number. Finally, provide the total amount paid during the year in the designated boxes for the specific type of payment. Always double-check each entry to avoid common 1099 mistakes like incorrect taxpayer identification or unwanted amendments later.

Electronic Filing of 1099 Forms

When considering electronic filing 1099, using an electronic submission method can greatly simplify your task. E-filing allows for quicker file submission and generally comes with built-in checks to correct any errors automatically. The IRS provides e-filing solutions that can reconcile information efficiently and ensure that you comply with their IRS 1099 instructions. Additionally, meeting 1099 deadlines is made easier through electronic submission, as confirmations and records are logged digitally.

Querying 1099 Reporting Requirements

With multiple 1099 requirements for businesses, it is essential to confirm what is necessary for your specific circumstances. This may involve keeping accurate records of payments throughout the year to ensure compliance and assistance in case of audits. Knowing the 1099 tax obligations supporting documentation needed will also facilitate smooth reporting.

Common Mistakes in 1099 Issuance

Recognizing common mistakes in 1099 issuance can save time and resources. Misreporting sums, failing to collect necessary information on recipients, or missing deadlines can lead to penalties and disputes. It’s vital to maintain meticulous records and to execute careful reviews of each submitted 1099 to avoid issues such as duplicate forms or inaccurate information.

Tracking 1099 Information Effectively

Using tracking tools for your 1099 recordkeeping can streamline the process. Keeping a clear log of payments made throughout the year, including receipt acknowledgments or invoices, is essential. This can minimize the risks of discrepancies in reported income and help defend against audits. Implementing proper documentation will aid in hassle-free filing during tax season.

Best Practices for Issuing 1099 Forms

Developing a framework for issuing 1099s is part of ensuring compliance. Make it a practice to review your policies regarding contractor payments and 1099 obligations regularly. Proper planning allows for adequate documentation to support all issued forms and can lessen the administrative load during tax reporting.

1099 Documentation Needed

The necessary 1099 documentation needed includes W-9 forms from contractors and freelancers, which provide essential taxpayer identification and other identifying information. Keeping copies of these forms will help identify whether the individual is categorized as an independent contractor or a corporation. Proper documentation and regard to IRS requirements should greatly minimize compliance risks.

Understanding 1099 Corrections

If any errors arise post-submission, understanding how to navigate 1099 corrections is paramount. If you notice an error, you must prepare a corrected 1099 form and submit it immediately to both the IRS and the recipient. Examples of what necessitates corrections include incorrect amounts reported, wrong addresses, or taxpayer identification numbers.

Conclusion

To properly navigate the process of how to issue a 1099, it is crucial to familiarize yourself with the types of forms, compliance requirements, and best practices for filling out and submitting these documents. Diligent record-keeping and timely submissions based on IRS guidance will ensure that you avoid common pitfalls and penalties associated with 1099 filing.

FAQ

1. What are the 1099 deadlines for 2023?

For the 2023 tax year, most 1099 forms must be filed with the IRS by January 31, 2024. This includes the 1099-NEC which reports payments to independent contractors. However, when filing electronically, businesses may have until March 31, 2024, to submit.

2. How do I know if I need to issue a 1099?

You need to issue a 1099 for independent contractors or any individual to whom you have paid $600 or more during the year for services rendered. However, payments made to corporations generally do not require a 1099. Keep accurate records to quickly navigate these decisions.

3. What happens if I miss the 1099 filing deadline?

Missing the 1099 deadline may result in penalties imposed by the IRS. The fine can increase depending on how late the 1099 is filed, reaching up to $260 per form for late filings. Ensure to submit corrections promptly to mitigate potential penalties.

4. Can I e-file my 1099 forms?

Yes, you can e-file 1099 forms through the IRS system or various third-party platforms designed for tax submissions. E-filing offers advantages including built-in error checks, and often shorter processing times compared to paper filings.

5. Are there specific 1099 forms for different services?

Yes, there are several types of 1099 forms tailored to specific payments such as the 1099-MISC for miscellaneous payments and the 1099-NEC for payments to non-employees. Each serves a different purpose, and it’s important to select the correct form to ensure proper compliance.

6. What is the penalty for not issuing a 1099?

Penalties for not issuing a 1099 can vary, with fines ranging from $50 to $260 per form, depending on how late the form is submitted. Inconsistent reporting can also lead to internal audits and scrutiny from the IRS.

7. How can I correct errors on a submitted 1099?

If errors are found after submission, you must complete a correction form and indicate the changes made. Notify both the IRS and the recipient of the corrected form as quickly as possible to prevent penalties.