“`html

How to Effectively Add Tax to Your Price

Understanding how to add tax to a price is crucial for businesses and consumers alike. Accurately calculating sales tax ensures compliance with tax regulations, affects pricing strategies, and influences customer perception. In this comprehensive guide for 2025, we’ll cover various aspects of sales tax, including tax inclusive pricing, calculating total price with tax, and effective pricing strategies for taxes. We’ll also explore different tax rates, how to accurately determine tax amounts, and best practices for incorporating tax into your pricing models. Let’s dive into the essential components of adding tax to your pricing.

Understanding Sales Tax and Its Implications

Having a foundational knowledge of how sales tax works is imperative for both businesses and consumers. Sales tax is a form of indirect tax collected by a seller from the buyer at the point of sale. Each jurisdiction may have different tax rates which can affect the price of goods and services significantly. For example, in the United States, sales taxes can vary widely between states and even local areas, influencing the overall pricing strategy. Therefore, understanding the applicable tax rates explained in your locality is vital for accurate pricing.

Sales Tax Rules and Regulations

The laws governing sales tax often come with complexities that can be overwhelming for small business owners. Each state or region has its unique sales tax rules, and it’s essential to be aware of them to avoid penalties. For instance, some states have exemptions for specific goods or industries, while others enforce different rates for products and services. Failing to grasp the local laws can lead to discrepancies in tax calculations for businesses and can result in hefty fines. Utilizing online resources or consulting with tax professionals can help clarify these rules and ensure compliance.

Implications of Tax on Final Pricing

When setting prices, businesses must consider how sales tax affects their overall pricing strategy. Including tax within the advertised price can lead to higher customer satisfaction, as it simplifies the process for consumers. However, tax inclusive pricing can raise the initial listed price and may lose appeal if customers are unaware of this practice. Effective communication about “final price computation” is key in marketing to ensure that customers understand their total costs, thus avoiding hidden fees that may lead to distrust.

Calculating Sales Tax Wisely

When determining how to calculate tax effectively, accuracy is crucial. The method you use can affect how much tax you collect and what you report to tax authorities. Having a clear understanding of calculating total price with tax begins with identifying applicable tax rates, which can differ based on products and locations. A business might employ various techniques to ensure calculations are streamlined and accurate, minimizing the risk of mistakes.

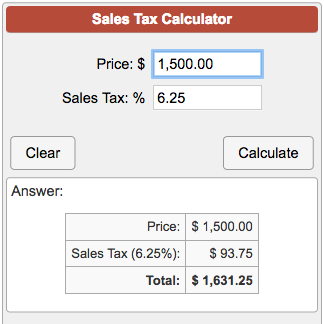

Simple Strategies for Tax Calculation

Applying simple tax calculation strategies can significantly simplify the pricing process. Most businesses utilize straightforward formulas for quick computations. An example includes multiplying the item’s price by the tax rate (essentially a decimal equivalent). For example, if an item costs $100 and the tax rate is 7%, the straightforward calculation would be $100 * 0.07 = $7. Thus, the total price after tax would be $107. Using online tax calculators can also speed up this process, ensuring that calculations are both accurate and easy to manage in high-volume sales situations.

Understanding Effective Tax Rate Calculation

The effective tax rate can affect how businesses price goods significantly. This rate represents the average rate at which a business pays tax and varies from gross sales to net income. Businesses must emphasize understanding their effective tax rate calculation as it helps in setting prices that cushion any financial impact from taxes. Evaluating sales historically and adjusting future prices accordingly can help maintain profit margins while remaining compliant with tax obligations.

Implementing Tax Adjustments on Invoices

Businesses must navigate tax adjustments effectively, especially on invoices issued to clients. Properly handling these adjustments is essential to ensure that both parties have a clear understanding of the final pricing, preventing potential disputes. This is particularly relevant in industries concerned with tax calculations for services, where service-based pricing can vary widely regarding tax applications.

Best Practices for Tax Application on Services

When providing services, understanding how to apply taxes properly is essential for compliance. Different tax rates may apply for goods versus services, and business owners should be mindful of these differences. For example, while consulting services might not incur sales tax in certain areas, they might be included in others, requiring thorough research into territory-specific regulations. Establishing clear tax application guidelines for invoicing can greatly reduce confusion for both businesses and customers.

Handling Sales Tax for Online Purchases

Online purchasing has revolutionized how sales taxes are applied, complicating some transactions. Some states require businesses to collect sales tax for online purchases, regardless of where the seller is located, resulting in a more complex tax landscape. For effective compliance, businesses must grasp sales tax rules and regulations for online transactions, ensuring they charge the proper amounts according to jurisdiction. Ignoring these factors could result in financial repercussions and damage to credibility.

Key Takeaways on Pricing with Tax

- Understanding local tax rates is essential for accurate product pricing.

- Simple tax calculations improve transparency and customer trust.

- Effective handling of invoices prevents disputes related to taxes.

- Online businesses must ensure compliance with varying sales tax laws.

- Clear communication can increase customer satisfaction regarding final pricing.

FAQ

1. What is the simplest method for adding tax to a price?

The simplest method for adding tax to a price involves multiplying the item’s cost by the tax rate. For example, if an item costs $50 and the tax rate is 5%, then the calculation would be $50 x 0.05 = $2.50. Therefore, the final price after tax would be $52.50. This straightforward approach is critical for businesses seeking to improve their price calculations with tax.

2. How can businesses automate tax calculations effectively?

Businesses can automate tax calculations by integrating accounting and point-of-sale software equipped with tax rate updates. These systems calculate applicable taxes instantly based on the billing address, ensuring accuracy in real-time. By simplifying the tax calculations for businesses, automation not only saves time but also minimizes inaccuracies during high-volume sales periods.

3. What are the implications of using tax inclusive pricing?

Using tax inclusive pricing can simplify the customer experience by providing a single price that includes all costs. However, this practice can sometimes drive higher purchase prices, possibly deterring customers at first glance. Therefore, transparent communication regarding the pricing structure is necessary to help customers understand the value. It also requires businesses to officially register and abide by their corresponding sales tax laws.

4. What are effective strategies for ensuring sales tax compliance?

To ensure sales tax compliance effectively, businesses should regularly update themselves on changing tax regulations, keep organized records of transactions, and utilize accounting software for tax reporting. Training staff on tax assessment and business tax compliance further prepares them to handle inquiries and manage calculations accurately, assuring a thorough grasp of required practices.

5. How do variable tax rates impact pricing strategy?

Variable tax rates can significantly impact product pricing strategies, especially for businesses selling across multiple jurisdictions. Different rates require businesses to adapt their pricing effectively based on regional demands, transport dynamics, and customer acceptance. Understanding these tax rate variations empowers businesses to optimize pricing strategies without compromising competitiveness in the market.

“`