Apply Now

Smart Ways to Buy a Car with a Pre-Approved Loan in 2025

Understanding Pre-Approved Loans

When you're considering purchasing a vehicle, one of the most beneficial steps you can take is securing a pre-approved loan. This means that a financial institution has evaluated your creditworthiness and is ready to lend you a specific amount of money at predetermined interest rates. Having this pre-approval boosts your confidence as a buyer because you know exactly how much you can spend, making the overall car buying process smoother. It also puts you in a stronger negotiating position, as dealers can see you are a serious buyer with financial backing. Instead of being enticed by attractive dealership financing offers, you can compare various financial institutions to see which one provides the best auto loan.

Moreover, understanding the importance of your credit score is crucial in the pre-approval process. A better score often translates into lower interest rates, which can save you a significant amount over the life of your loan. Before applying, it’s wise to check your credit history and rectify any inaccuracies, making you a more appealing candidate for loan approval.

Budgeting for Your Car Purchase

Establishing a budget is integral before you venture into the car buying market. This budget should include costs beyond the actual loan repayments. Consider down payments, insurance, registration fees, and possible maintenance costs. When setting your budget, use an auto loan calculator to ascertain how different loan amounts, interest rates, and terms will affect your monthly payments.

Staying within budget is essential; assess your monthly expenses critically and determine how much you can afford to allocate for your car payments. By creating a detailed financial plan, including loan repayment strategies, you will be better positioned to handle any unexpected costs that might arise post-purchase. It’s also beneficial to explore options for financing, such as whether opting for financing vs cash makes sense for your financial situation.

Exploring Financing Options

Once you've laid out your budget and secured pre-approval, it's time to delve into various financing options available. Aside from traditional banks or credit unions, various financing companies and dealerships can also offer competitive rates. Each has its pros and cons that can directly influence your overall financial situation.

Evaluate the loan terms offered by different institutions – this includes interest rates, repayment duration, and any associated closing costs. Take the time to compare documentation needed for application processes; some lenders may require more paperwork than others. Understanding loan terms can guide your decision-making process.

Additionally, don't overlook the potential benefits of dealership financing. While they may provide incentives that appeal to buyers, always compare these offers against your pre-approved loan. Sometimes, dealerships can offer promotional rates, making them a viable option to consider.

Negotiating the Purchase Price

With financing squared away, the next crucial step in purchasing a car is learning how to negotiate the price effectively. Armed with your pre-approved loan, you possess leverage, allowing you to present yourself as a serious buyer. Don’t be afraid to negotiate, as the sticker price isn’t often the final price you'll pay.

Consider researching the fair market value of the car you are interested in using vehicle history reports and comparison sites. This allows you to speak knowledgeably during negotiations. Also, factoring in trade-in value can substantially affect the overall costs. Being informed and prepared can lead to significant savings.

Many buyers enter dealership negotiations unprepared, which can lead to overpaying. Establishing a clear target price along with any financing options beforehand can improve your bargaining success. Always remember, the goal is not just to finalize the deal but to ensure that it aligns with the financial plans you’ve set.

Finalizing Your Purchase and Understanding the Process

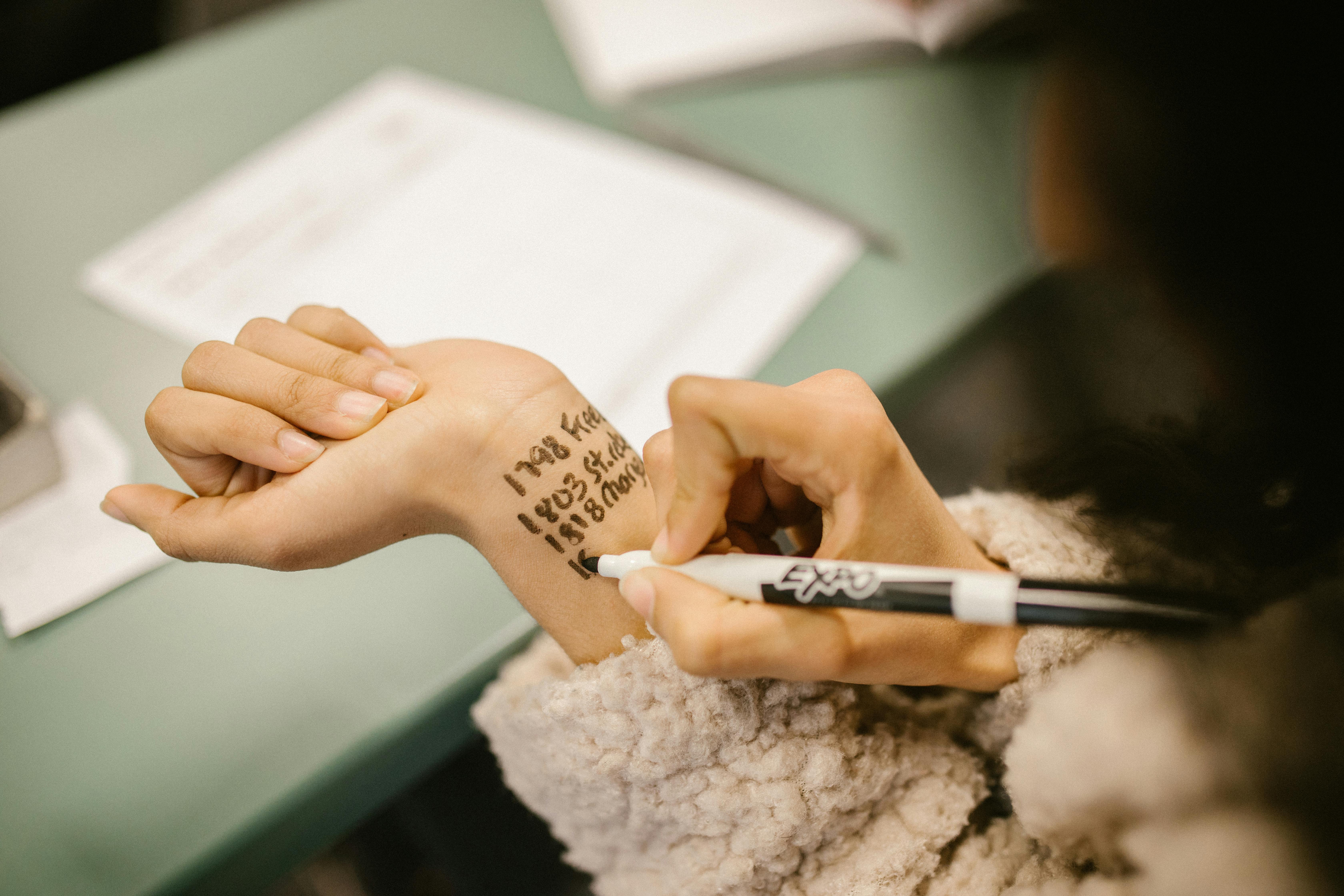

After successful negotiations, it’s important to understand the documentation needed to finalize your vehicle purchase. This includes providing proof of insurance, your driver's license, and any trade-in paperwork you might have.

Review all loan documents carefully, ensuring that the loan terms discussed are accurately reflected. Being vigilant can help you avoid common pitfalls associated with auto loans, such as hidden fees or unfavorable interest rates. Your auto loan advisors can assist you in understanding the fine print.

After closing the deal, consider practical aspects like registration, car insurance, and future maintenance. It’s essential to prioritize understanding and managing your post-purchase financing as it can heavily impact your future financial well-being.

Common Pitfalls and How to Avoid Them

Be Wary of Overextending Your Budget

One important mistake many buyers make is overextending their budgets, leading to financial strain in the long run. To avoid this, continuously reassess your financial situation and abilities before committing to a loan amount that exceeds your comfort level.

Adjust your expectations based on current economic conditions, including fluctuating interest rates. This will help you avoid monthly payments that are not sustainable in the long haul, enabling you to stay on top of your car loan repayment plan without undue stress.

Ignoring the Impact of Interest Rates

Another mistake is underestimating the importance of interest rate comparisons. The difference in interest rates can significantly affect the total amount paid. Utilize online tools to evaluate loan offers and interest rates thoroughly before making any commitments.

Moreover, remember that interest impacts not only your monthly payments but also the overall cost of the vehicle over time. Strive to secure the most favorable rates possible by shopping around with various lending institutions.

Neglecting to Understand Loan Documents

Many buyers rush through the loan documentation process, not fully understanding their commitments. To prevent confusion, take the time to review each document thoroughly and clarify any uncertainties with your lender. Ask specific questions regarding the terms of the loan, additional costs, and penalties for early repayment if any.

Investing time in understanding your loan terms will empower you to make informed decisions and avoid financial difficulties down the line.

Not Having a Solid Vehicle History Report

When purchasing a used car, neglecting to obtain a vehicle history report could be a critical mistake. This report provides essential information about a car's past, including any accidents, title issues, and previous ownership, allowing you to make an informed decision.

Always request a vehicle history report before finalizing any used car purchase. This information can both aid in negotiating price and protect you from future unexpected costs associated with hidden damages or issues.

Best Practices for Managing Your Car Loan

Once you’ve secured financing and purchased your vehicle, adopting effective practices for managing your auto loan can make a significant difference. Keeping a close eye on your loan’s interest rates and terms will help you stay on top of payments.

Set reminders for monthly payments and evaluate your overall financial health regularly. It's also a good idea to stay informed about refinancing options should your circumstances change, allowing you to secure a lower interest rate.

Finally, consider the benefits of additional payments towards your principal balance if you have extra funds. This can help reduce your loan's duration significantly, lowering the total interest paid.

Q&A Section

What Does Pre-Approval Mean for Car Financing?

Pre-approval indicates that a lender has evaluated your financial situation and is willing to lend you a specified amount. This gives you clear limits when browsing for a vehicle without risking overspending.

How Can I Improve My Credit Score Before Buying a Car?

Improving your credit score can usually be achieved by paying down debt, ensuring bills are paid on time, correcting any inaccuracies in your credit report, and avoiding new loans or credit lines before applying for a car loan.

Is Dealership Financing Better Than My Bank’s Offer?

Each situation is unique. It’s wise to compare the financing offers from both your bank and the dealership to determine which provides more favorable interest rates and terms before making a commitment.

What Should I Do If I Get Denied for a Loan?

If you are denied a loan, it’s important to understand why and review your credit report for issues that can be rectified. Consider consulting with a financial advisor to explore alternative financing options tailored to your financial situation.

How Can I Maximize My Trade-In Value?

To maximize trade-in value, thoroughly research your vehicle's worth, maintain good condition, and present maintenance records. Being knowledgeable and prepared can significantly improve your negotiation power.