How to Optimally Pay Yourself as a Business Owner in 2025: Smart Tips for Maximizing Profits

As a business owner in 2025, determining how to effectively pay yourself is not only crucial for your personal financial well-being, but it also plays a significant role in the overall health of your business. With the evolving landscape of taxation, business structures, and financial planning, understanding your compensation options has never been more important. Knowing the intricacies of owner draw vs salary, self-employment income, and compliance can greatly enhance the sustainability of your enterprise. By mastering the methods of paying yourself from your business, you can maximize profits while adhering to legal requirements.

This article will walk you through various strategies for setting your pay as a business owner, delve into the implications of salary structuring, and provide actionable tips to ensure that you are compensating yourself in a tax-efficient manner. We'll explore aspects such as business income distribution, payroll methods for business owners, and best practices for owner pay to help maintain your financial health.

Get ready to optimize your compensation strategy by exploring essential guidelines and innovative methods tailored for forward-thinking entrepreneurs. Key takeaways will include practical tips on managing business finances and aligning your personal financial goals with your business objectives.

Understanding Business Owner Compensation

To effectively pay yourself, it’s important to understand the different forms of compensation available to business owners. Each option has its advantages and legal requirements, which can impact your financial outcomes.

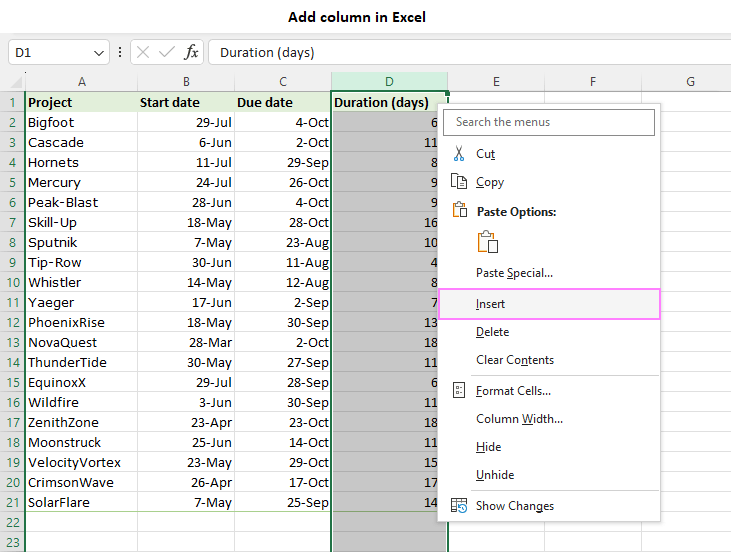

Exploring Owner Draw vs Salary

When considering how to pay yourself as a business owner, one of the first decisions is whether to take an owner draw or a salary. An owner draw is a distribution of profits from the business and is typically used by sole proprietors and partners. This method offers flexibility but may come with implications for self-employment taxes.

On the other hand, paying yourself a salary establishes a clear structure that complies with payroll regulations. It can provide consistency in income and assist with personal financial planning. Nevertheless, business owners must ensure that the salary is reasonable in relation to the industry standards to avoid IRS scrutiny.

Owner Salary Calculations

Calculating a reasonable salary requires evaluating multiple factors including your business revenues, the roles and responsibilities you undertake, and the prevailing market rates for similar positions. Tools such as compensation calculators can aid in determining fair pay rates based on comprehensive financial analyses. It's also advisable to consult industry standards when assessing owner salary benchmarks.

Legal Requirements for Owner Payment

Understanding legal requirements surrounding owner payments is crucial. Maintaining compliance with IRS guidelines is essential as mismanagement of compensation can result in audits or penalties. Ensure to keep records of payment methods, structures, and the justification of salary levels.

Tax Implications of Paying Yourself

The method you choose to pay yourself will also influence your tax obligations. Salary payments are subject to payroll taxes whereas owner draws may impact how you file your personal income taxes. Understanding these implications can help you plan for quarterly taxes and mitigate potential liabilities.

Methods for Paying Yourself Effectively

There are various methods for compensating yourself as a business owner, from traditional salary structures to distributions. Evaluating each method through the lens of tax efficiency can lead to smarter financial choices that bolster your net income. Methods such as paying yourself through dividends or profit-sharing can enhance cash flow and align incentives with business growth.

Building on these fundamentals, we will explore practical strategies to help you maximize your compensation while ensuring the financial health of your business.

Best Practices for Owner Salary Strategies

Having a strategy for how to set your pay as a business owner involves planning and consistency. Best practices can not only guide your compensation decisions but also contribute to your long-term financial objectives.

Leveraging Business Income Strategies

Utilizing business income strategies can optimize your personal finances. This may involve reinvesting profits back into the business while determining an appropriate draw that meets both personal and professional needs. Fluctuating market conditions and business performance can delineate your monthly salary levels versus the amounts you withdraw from profit distributions.

Budget Planning for Business Salaries

Establishing a budget specifically for owner compensation is key. Create a financial plan anticipating varying income flows throughout the year. This will also assist in determining the right timing for salary and draw adjustments based on business performance and personal financial needs.

Quarterly Taxes for Business Owners

As a business owner, being aware of your responsibilities concerning quarterly taxes can prevent cash flow headaches. Setting aside funds for tax obligations and understanding deductions related to owner salary can considerably enhance your financial standing.

Smart Financial Choices for Owners

Continuous education about financial literacy and keeping up with changes in tax laws are essential for making informed decisions. Business owners should also assess the viability of hiring an accountant to help navigate the complexities of payroll and tax advice tailored to their specific situation.

Balancing Business Expenses and Owner Salary

It’s vital to strike a balance between managing business expenses and your salary to maintain a healthy cash flow. By understanding your business model and revenue streams, you can ensure that both personal and business financial needs are met without jeopardizing operational sustainability. This includes analyzing the cost-effectiveness of various compensation methods.

As we delve deeper, let’s examine the implications of various payment methods and how they can influence your overall income strategy.

Payment Methods for Business Owners

Choosing the right method to compensate yourself enables better management of personal and business finances. Each payment route comes with its own set of principles, pros, and cons.

Owner Withdrawals Explained

Owner withdrawals are a simple way to extract profits from your business without the complexities of payroll. This method allows for flexibility in income but should consider the tax implications that arise from withdrawing funds that are categorized differently from salary.

Paying Yourself Through Dividends

If your business structure allows, paying yourself through dividends can be tax-efficient. This is particularly true for LLCs and corporations where owners can declare dividends based on profit margins. Understanding the legal ramifications and ensuring you adhere to state regulations is critical when utilizing this payment method.

Payroll for Business Owners

Establishing a formal payroll system for paying yourself adds structure to your compensation. This method can streamline tax withholdings and ensure compliance with employment regulations. Using payroll software can aid in tracking income and ensuring timely tax contributions.

Alternative Compensation Structures

Exploring alternative compensation structures such as profit-sharing plans can align your pay with your business performance. This type of compensation can promote growth and create incentives for reinvestment as both the business and personal income can benefit from shared successful outcomes.

Reinvesting in Your Business

Many entrepreneurs choose to reinvest a portion of their income back into the business. This decision can yield positive long-term growth while still allowing for personal compensation, thus helping manage both personal and business financial obligations effectively.

Financial Health of Your Business

As you navigate through compensation methods, maintaining the financial health of your business must remain a top priority. Assessing your business profitability, understanding cash flow, and making informed financial decisions are vital steps in this journey.

Understanding Cash Flow

Proper cash flow management is essential for determining your ability to pay yourself. Ensure you maintain sufficient liquidity to meet both personal and professional expenses. Implementing cash flow forecasting can provide valuable insights into revenue consistency and predict fluctuations that may impact owner compensation.

Owner Income Tax Considerations

Your compensation method significantly impacts your tax obligations. Awareness of self-employment tax planning and exploring deductions can optimize your tax strategy. Staying informed on profit margins and understanding how they relate to owner pay can significantly improve overall financial health.

Impact of Salary on Business Success

The relationship between your salary and business performance is crucial. It's essential to align your pay with the business’s profitability and growth potential to avoid financial strain while motivating business continuity. Understanding this dynamic allows for informed decision-making and long-term sustainability.

Financial Metrics for Owners

Incorporating financial metrics and indicators tailored for owners can provide clarity on sustainable compensation strategies. Regular evaluations of your financial health can guide adjustments and improve your compensation approach.

Evaluating Risks Associated with Low Salary

Consider the risks of under-compensating yourself which may affect your financial stability and business motivation. A balanced approach to your salary is critical to personal well-being and fostering a thriving business environment.

Q&A Section

What compensation method is best for me?

The best method for compensation can vary based on your business structure, profitability, and personal needs. Consult with financial experts and consider your long-term goals to find the optimal fit.

How can I determine a reasonable salary?

Assess your roles, industry standards, and business performance to establish a reasonable salary. Utilize market data, compensation calculators, and expert insights to strengthen your analysis.

Are there tax benefits to paying myself as a salary?

Yes, paying yourself a salary can have tax advantages, including predictable payroll tax deductions and potential benefits associated with retirement structuring.

How do I manage cash flow for owner pay?

Implement cash flow management techniques like budgeting, forecasting, and understanding revenue cycles to easily assess your capacity for paying yourself.

What are the consequences of not paying myself adequately?

Failing to compensate yourself adequately may lead to financial strain and decreased motivation for business growth. It's critical to maintain a sustainable level of compensation to align personal and business objectives successfully.