Effective Ways to Eliminate PMI: Streamline Your Mortgage Savings in 2025

Private Mortgage Insurance (PMI) can be a significant expense for homeowners. Eliminating PMI can lead to substantial savings over time, allowing homeowners to take control over their mortgage costs. In this article, we will explore various effective strategies and actionable steps to help you *remove PMI from reports.* We will also delve into the **PMI removal process**, highlighting the best practices for a smooth transition. With our insights into effective PMI management techniques, you’ll be well-equipped to navigate PMI challenges and enhance your financial health.

Understanding PMI and Its Implications

Before we discuss how to eliminate PMI, it’s essential to understand what PMI is and why it exists. PMI is usually required by lenders when a borrower makes a down payment of less than 20% of the home’s purchase price. It protects the lender in case of default on the mortgage. While PMI can make homeownership possible for many, it can also affect your financial situation significantly. Knowing how to handle PMI responsibly and reduce its impact is crucial for financial well-being.

Evaluating PMI Options and Their Costs

To effectively address PMI, one must first evaluate the costs associated with it. Analyzing *PMI costs breakdown* can help you understand how much it adds to your monthly payments. Explore options like PMI alternatives or seeking lenders that offer lower PMI rates. Assess the long-term financial implications of carrying PMI versus the cost of other mortgage options. It can also be beneficial to look into PMI removal eligibility; you may be closer to cutting it out than you think.

Benefits of Housing Without PMI

One of the most significant benefits of *eliminating PMI liabilities* is the potential for significant savings. Once PMI is removed, more of your mortgage payment goes toward principal and interest, ultimately benefiting your equity buildup. Additionally, being PMI-free can simplify your financial planning when preparing for major expenses or investment opportunities. Furthermore, without the obstacle of PMI, home equity may become more accessible for renovations or other financial goals.

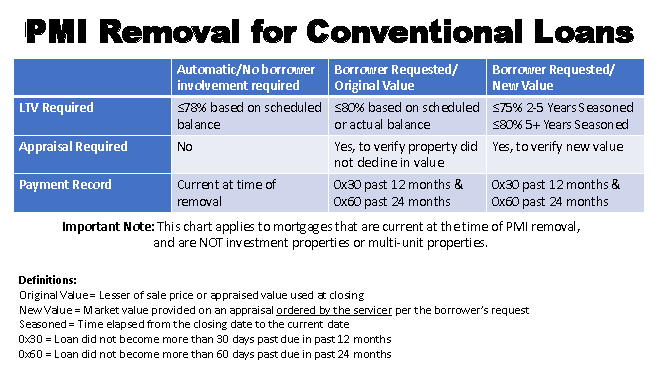

Understanding PMI Removal Criteria and Regulations

The *PMI removal process* has specific criteria that homeowners must meet. Familiarize yourself with common PMI cancellation criteria, such as home value assessments and remaining mortgage balances. Understanding **PMI regulations** will help you prepare for negotiations with your lender. Regularly reassessing your home’s value and keeping documentation will smooth the path toward removing PMI, allowing a proactive approach for your financial growth.

Effective PMI Strategies to Mitigate Costs

Now that we have a grasp of PMI’s impact, it’s essential to implement effective strategies for *reducing PMI impact*. This can include refinancing, restructuring existing loans, and taking advantage of the present market conditions. Taking informed, proactive steps can lead to improving your financial outlook materially.

Refinancing as a Solution

Refinancing your mortgage could be a robust way to *remove PMI from financials*. If your home’s value has increased since you purchased it or the market has improved, refinancing can allow you to reset your loan-to-value ratio below the 80% threshold, thus eliminating PMI. This act is one of the most common *PMI reduction solutions*, enabling homeowners to achieve lower interest rates and better terms while facilitating PMI eradication.

Negotiating with Your Lender

Engaging in open dialogue with your lender can yield favorable outcomes when dealing with PMI. Understanding *PMI negotiation techniques* can empower you to advocate for reduced PMI responsibilities. If your home’s value has appreciated, present this information when discussing PMI cancellation and seek ways to expedite the *PMI removal process* by leveraging your current situation. Establishing good communication is key in assuring transparency during these transactions.

Implementing PMI Auditing Techniques

Regularly conduct audits on your PMI standings. By utilizing effective *PMI auditing techniques*, you can ensure you are aware of any changes in your property value, loan balance, or market conditions. Gathering systematic reviews of your mortgage and its embedded costs allows for a precise strategy in *addressing PMI effectively*. Keep your lenders informed about any significant property upgrades or market insights that could positively impact your PMI situation.

Proactive Approaches for Long-term PMI Management

As market dynamics can shift quickly, having *proactive PMI removal* plans will ensure long-term success in managing these costs. Rather than waiting for PMI mitigation to take place, you can strategize for seamless removal in the future. Here are a few focused tactics that dive deeper into PMI management.

Increasing Equity Through Additional Payments

Making extra payments towards the principal on your mortgage can build equity faster, eventually allowing you to reach that crucial 80% mark sooner. By following *actionable steps to remove PMI*, you’ll force a dynamic shift in your borrower-lender relationship, creating avenues for refinancing or termination of your PMI. Each additional payment is a step closer to proactively addressing PMI liabilities.

Establishing a PMI Feedback Mechanism

Setting up an organized PMI feedback mechanism with your lender can be remarkably beneficial. Regular check-ins can provide transparency into your *PMI compliance status,* building a collaboration platform that works mutually to solve issues as they arise. Whether it’s setting up milestones for reevaluating the necessity of PMI, or confirming eligibility for its removal, consistent communication contributes greatly to successful management of PMI.

Consulting Professional PMI Support

Lastly, connecting with professionals who specialize in PMI can provide valuable insights and strategies when facing *PMI challenges*. Understanding the many available tools and techniques for *managing PMI* can lead you to innovative solutions that you hadn’t considered before. This expertise can not only ease the burden of PMI but can also transform it into an opportunity for better mortgage management.

Key Takeaways

- Eliminating PMI significantly reduces mortgage payments and enhances financial health.

- Active communication with lenders and ongoing PMIs assessments can lead to smoother adjustments.

- Increasing equity through additional payments can hasten PMI removal eligibility.

- Refinancing can often provide the best way to remove PMI, especially when property values rise.

- Employing professional support can uncover new strategies for successful PMI management.

FAQ

1. What are the criteria for removing PMI?

To remove PMI, homeowners typically must meet several criteria, including reaching at least an 80% loan-to-value ratio. This can be achieved through either paying down the principal balance or an increase in the home’s market value. Providing your lender with a recent appraisal reflecting your home value can help expedite the PMI *removal process*.

2. How can refinancing help with PMI challenges?

Refinancing can eliminate PMI if your new loan reduces the loan-to-value ratio to 80% or less, especially beneficial in a rising market. By capitalizing on equity growth, refinancing presents a *PMI reduction solution* while potentially securing a better interest rate, impacting your monthly payments positively.

3. What steps do I need to take for effective PMI negotiations?

To negotiate successfully, gather data regarding your home’s current value and prepare any relevant documentation that supports your case. Utilize *communication tactics* effectively during discussions with lenders, highlighting any equity gained and market changes that warrant consideration for PMI elimination. Remain assertive yet respectful in negotiations to foster good outcomes.

4. How often should I evaluate my PMI status?

It’s recommended to evaluate your PMI status annually or whenever significant changes in your property value occur. Regular assessments help in identifying potential *PMI reduction solutions* and keep you firmly informed about your eligibility for eliminating PMI at the opportune moment.

5. Are there PMI alternatives available?

Yes, PMI alternatives exist, such as opting for a lender-paid mortgage insurance plan or seeking programs that allow for lower down payments while avoiding PMI completely. Exploring *alternative mortgage options* can enable purchasing a home without the added cost of PMI.