Smart Ways to Make an ACH Payment in 2025

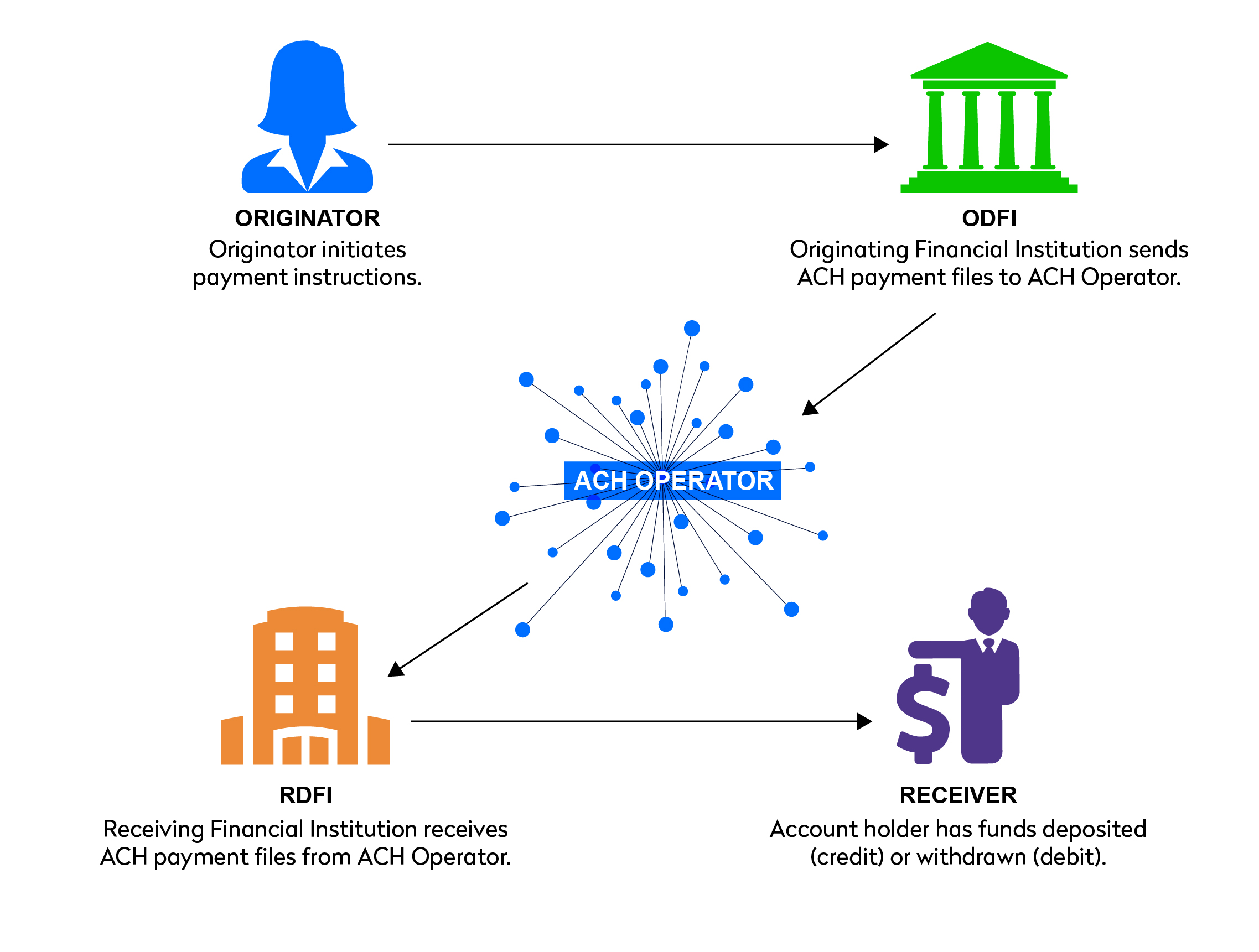

Understanding the ACH Payment Process

To leverage the **ACH payment process** effectively, it is vital to grasp how it works. The Automated Clearing House (ACH) network is a centralized electronic payment system that facilitates transactions between banks, making it easier for businesses and individuals to transfer funds. Understanding the fundamental **ACH payment guidelines** can help you safely and efficiently navigate the complexities of electronic money transfers. Typically, achieving success with ACH payments involves setting clear procedures, ensuring compliance with the latest regulations, and implementing security measures throughout the transaction process.

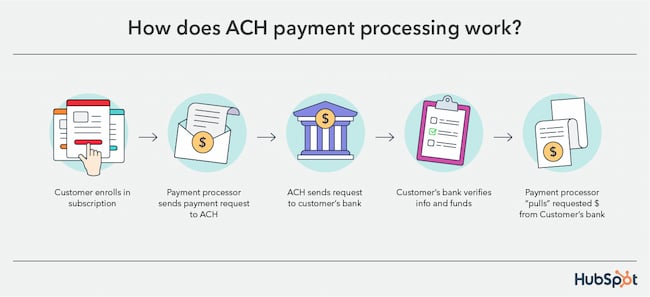

Steps for Making an ACH Payment

When you initiate an ACH payment, whether for personal or business purposes, there are specific **ACH payment steps** to follow to ensure a smooth transaction. Begin by collecting essential details such as the recipient’s bank information and account number. Next, fill out the necessary **ACH payment forms**, which usually include authorization agreements that approve recurring transactions if needed. Setting up an **ACH payment authorization** allows you to automate future transactions like payroll or bill payments. By understanding each step and utilizing available resources, you can make the **ACH payment setup** easier and error-free.

ACH Payment Authorization for Greater Security

To maximize security during the **ACH payment setup**, obtaining proper **ACH payment authorization** is critical. Authorization is the formal agreement that allows a specific amount to be withdrawn from your account to another party. Whether you’re authorizing a one-time payment or a series of recurring ACH payments, ensuring that documents are clear and complete helps avoid misunderstandings or disputes later. Moreover, leveraging modern banking strategies, such as **ACH payment verification**, enhances the accuracy of each transaction.

The Benefits of ACH Payments

Adopting **ACH payment benefits** can significantly impact your financial operations. From reduced transaction costs compared to credit card payments to the speed and efficiency of electronic funds transfer, the **ACH payment method** offers numerous advantages. ACH payments are known for their reliability, especially for managing bills or payroll—a major plus for businesses looking to streamline their payment processes. By reinforcing your understanding of ACH transactions, you can take full advantage of these benefits while ensuring compliance with ACH payment regulations.

Utilizing ACH Payment Technology

In 2025, technology plays a significant role in optimizing the **ACH payment process**. From software solutions that facilitate easy **ACH payment tracking** to improving automated payments, leveraging technology allows for seamless management of transactions. Businesses that engage users in their payment systems with digitized platforms can benefit from increased efficiency and user satisfaction, leading to improved cash flow management. Invest in reliable **ACH payment software** that aligns with your needs for expanded capabilities.

ACH Payment Processing Time and Tips

Understanding **ACH payment processing time** is crucial when planning your transactions. While ACH payments usually process within one to two business days, several factors, including the timing of the transaction and specific bank policies, can affect this duration. It’s advisable to avoid scheduling payments close to weekends or holidays, which might delay processing. To improve efficiency and reliability, implement **ACH payment management** practices, including reminders for upcoming payments and regular reconciliations to keep track of funds.

Risks and Compliance Considerations

Despite being a secure payment method, the **ACH payment system** is not without risks, including potential fraud. This necessitates comprehensive **ACH payment risk management** strategies to protect both your business and its clients. Staying updated with changes in **ACH payment regulations** ensures compliance and minimizes the risk of having funds displaced or misappropriated. Be sure to educate yourself on fraud detection mechanisms and regular monitoring, such as **ACH transaction monitoring**, for safer transactions.

Smart Strategies for Initiating ACH Payments

Implementing smart strategies regarding your **ACH payment options** can lead to significant cost savings and greater efficiency. For businesses looking to implement **ACH payment for payroll**, integrating these systems with existing HR software can restructure employee payment methods inexpensively. Moreover, personal users can benefit from **ACH payment for bills**, automating payments to avoid late fees and service interruptions. Establishing defined **ACH payment planning** can enhance cash flow accuracy and reduce manual entry errors.

Recurring ACH Payments Setup

One of the standout features of the ACH network is the capability for **recurring ACH payments**. If you have regular outgoing payments such as subscriptions or bill payments, you can set these to occur automatically on a specified date. This automation not only saves time but also minimizes the risk of late fees. Having a clear understanding of your account’s balance before automating payments ensures a seamless process. Users must keep track of **ACH payment limits** to avoid unexpected overdrafts that can arise when setting these types of payments.

Best Practices in ACH Payments

Establishing **ACH payment best practices** will streamline your electronic transaction processes. Document your ACH payment procedures meticulously, familiarize yourself with necessary agreements, and incorporate strong internal controls around the handling of sensitive information. Periodically review your **ACH payment reconciliation** process to identify any discrepancies in billing. This attention to detail not only underscores security but also boosts operational efficiency across your financial systems.

Key Takeaways

- Understand and follow the **ACH payment process** and **transfer guidelines** for secure transactions.

- Maximize the benefits of ACH payments through proper **setup** and automation.

- Invest in reliable **ACH payment software** to track and manage payments effectively.

- Stay compliant with changing **ACH payment regulations** to minimize risk.

- Utilize practices such as **recurring ACH payments** to streamline finances.

FAQ

1. What is the average ACH payment processing time?

The typical **ACH payment processing time** ranges from one to two business days. However, transactions initiated on certain days, like weekends or holidays, may experience extended processing times. For optimal timing, plan your payments to avoid these delays.

2. How can I ensure the security of my ACH payments?

Ensuring **ACH payment security** involves best practices like obtaining proper **ACH payment authorization** before transactions, regularly monitoring transactions, and using reputable **ACH payment service providers**. Educating yourself about **ACH payment fraud** and implementing precautionary measures are also instrumental in safeguarding your funds.

3. Can I automate my recurring ACH payments?

Yes, establishing **recurring ACH payments** is an excellent way to automate regular transactions such as payments for utilities or subscriptions. Setting this up provides you with peace of mind, ensuring that your payments are always made on time without manual entry.

4. Are there fees associated with ACH payments?

While **ACH payment fees** are generally lower compared to traditional payment methods, many banks may charge nominal fees for executing certain types of transactions. It’s wise to review your bank’s pricing model to understand any potential costs involved.

5. What are some common challenges with ACH payments?

Some common **ACH payment challenges** include potential delays due to bank processing times, compliance issues, and misunderstanding of the required **ACH payment documentation**. Sticking to best practices and keeping abreast of changes can help mitigate these challenges significantly.