Effective Ways to Remove Paid Collections from Your Credit Report in 2025

If you’re looking to remove paid collections from your credit report, you’re not alone. Many consumers face the challenges associated with deleting collections from credit reports and the impact it has on their overall credit score. In this guide, we will explore proven methods for managing and expunging these negative items from your credit history, along with practical tips on how to enhance your credit profile effectively.

Understanding Your Credit Report

Before diving into the methods for removing paid collections, it’s essential to fully understand what a credit report is. A credit report is a detailed record of your credit activity and payment history managed by various credit reporting agencies. It significantly impacts your credit score. If you have collections on your credit report, they can lead to negative credit consequences affecting your ability to secure loans or qualify for lower interest rates in the future.

How Collections Impact Your Credit Score

Collections are reported to the credit bureaus when a debt hasn’t been paid as agreed, often affecting your credit utilization ratio and credit history. Typically, many consumers see their credit score decline substantially when collections appear on their reports. According to FICO scoring models, having collections can drop your score by up to 100 points, depending on your overall credit profile. Understanding this impact can motivate you to develop a strategy for dealing with collections and improving your creditworthiness.

Timeline for Collection Removal

Once a collection account is paid, it can remain on your credit report for up to seven years. However, the account status will change to “paid,” which may favorably affect your credit score over time. Knowing the timeline for collection removal allows you to manage your financial planning more effectively. If you’re looking for quicker results, understanding applicable sentiment underlying consumer credit laws is critical, as there are legal avenues you can explore.

Regularly Check Your Credit Report

It’s vital to stay on top of your credit report regularly. Access your credit report—many services allow you to check your credit score for free. This means you can identify any credit report inaccuracies, including any potential false collections, ensuring you can act promptly. Maintaining regular checks also equips you with insights into your financial health, guiding you to take actions to develop effective credit repair strategies.

Strategies for Removing Paid Collections

Effective strategies for removing paid collections from your credit report can range from simple tips to more intricate negotiation techniques. One significant tip is to consider leveraging a formalized dispute process overview. When approaching collections, understanding your rights as a consumer is vitally important, especially if the collections are inaccurate or the creditor failed to comply with legal guidelines.

Negotiate with Creditors

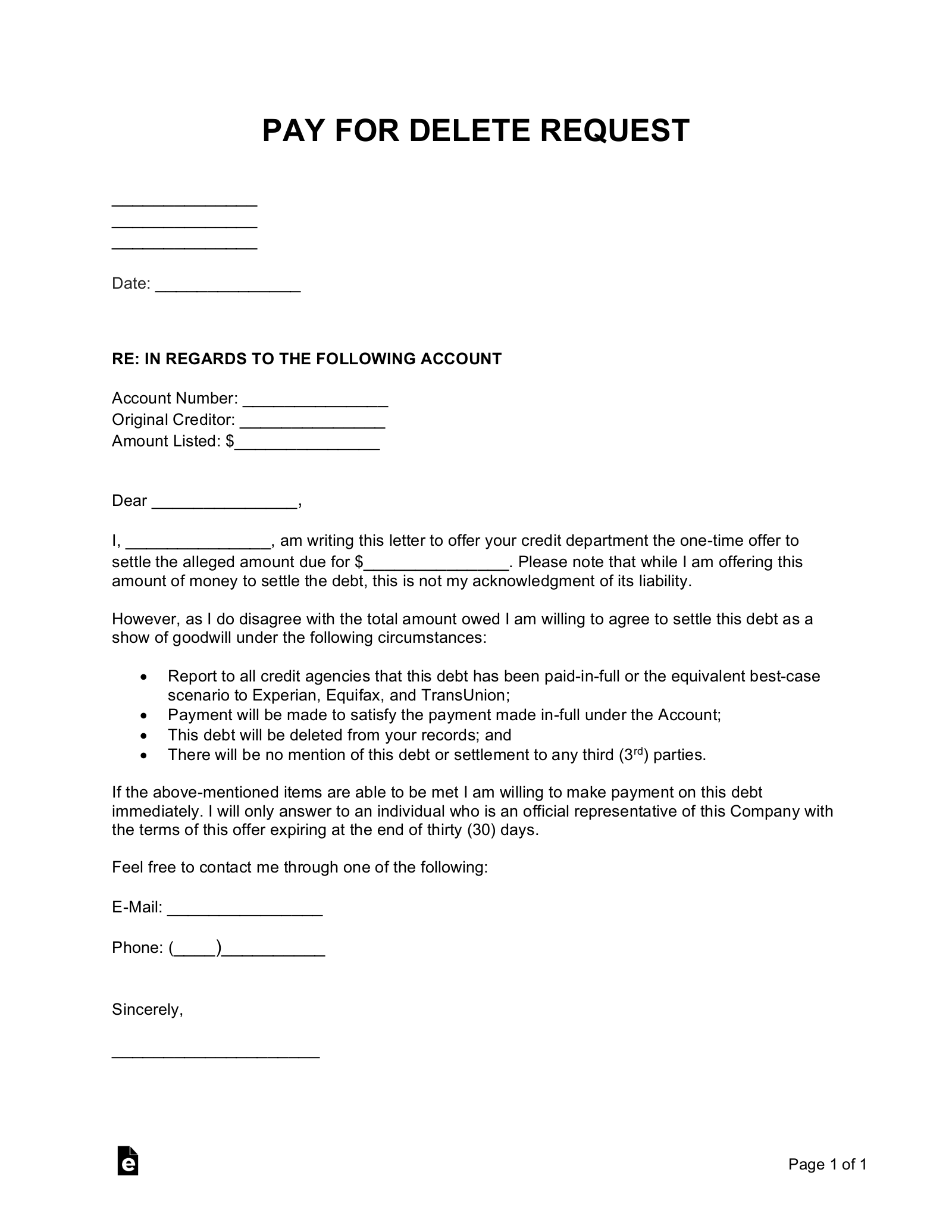

Communicating directly with collectors can sometimes yield favorable results. Consider discussing options that may include a pay-for-delete agreement, where a collector agrees to remove the account from your report in exchange for payment, even if it’s partial. This negotiation can help facilitate the restoration of your credit rating.

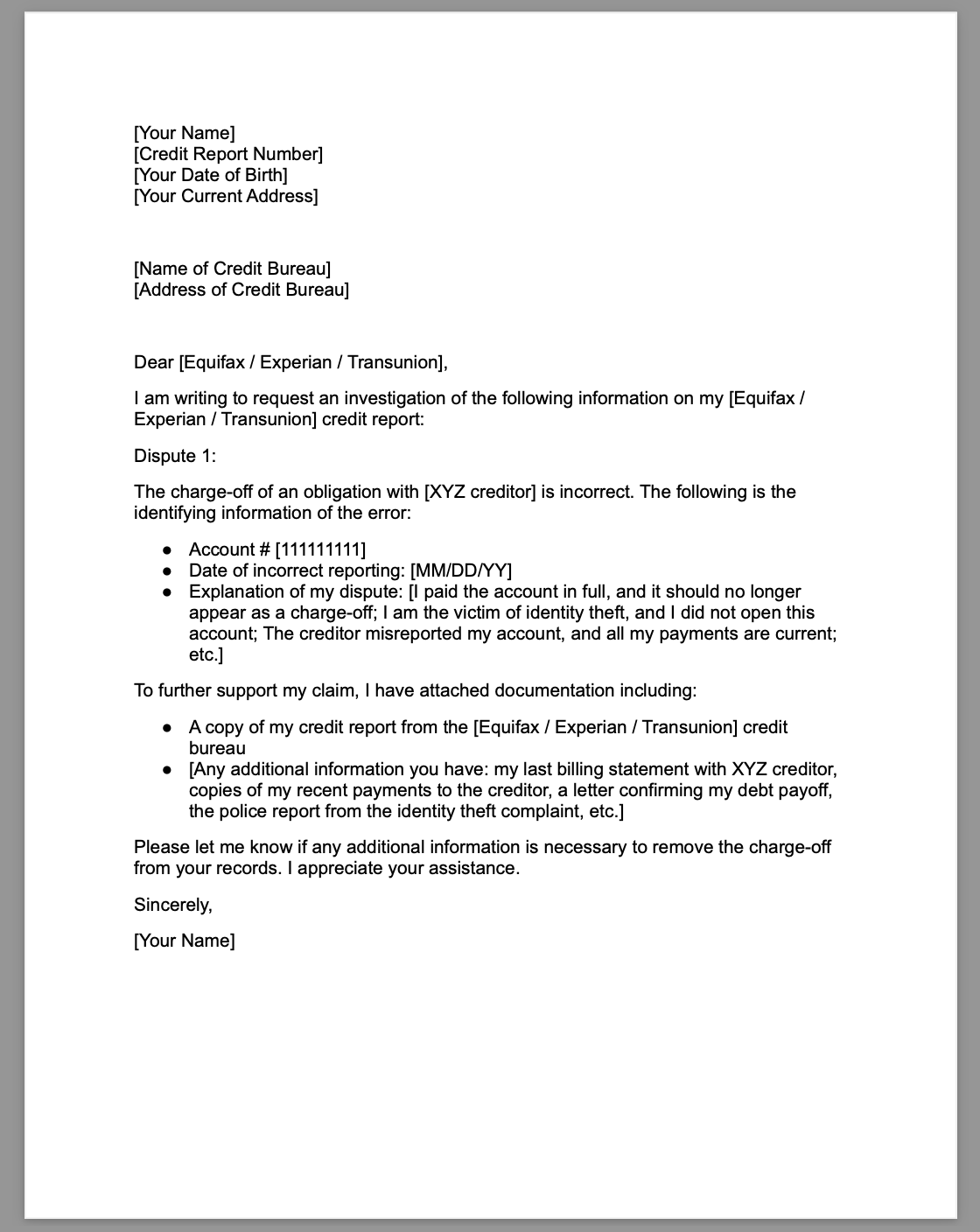

Filing a Dispute for Errors

If you discover errors or inaccuracies, filing a dispute with the credit reporting agencies should be your next step. Utilize a well-crafted dispute template to identify the problematic items. Addressing the errors allows agencies to conduct their investigation and remove the inaccuracies, which can improve your credit report. This process can initially involve tedious work but is extremely beneficial for maintaining your financial integrity.

Utilize Professional Services

Engaging professional credit repair services may also prove crucial if self-managed approaches fail. Many individuals choose to seek help from credit counseling services to navigate the choppy waters of debt and collections. Such professionals offer tailored advice and tailored strategies that may expedite the process of improving one’s credit history.

Developing a Positive Credit Habit

In addition to removing paid collections, sustaining those gains through positive credit behaviors is vital. Implementing good habits, such as timely payment schemes and monitoring your financial behavior, can significantly impact your long-term financial health and credit score.

Managing Debt Effectively

Understanding how to cope with debt effectively lays on maintaining open communication with creditors. Developing individualized debt repayment planning strategies can help diminish existing debts while keeping your credit utilization ratio in check. By taking control of your debt management, you make progress toward solidifying your credit position.

Monitoring Your Financial Behaviour

Utilize credit monitoring services that provide ongoing updates about your credit status, keeping you informed of changes and potential impacts on your credit profile. By actively engaging with your financial health through regular checking, you empower yourself, making informed decisions affecting your credit score factors, thus fostering a sustainable credit plan.

Continuously Educate Yourself on Consumer Rights

Understanding the charter of consumer rights concerning debt and credit reporting can serve as lasting protection against legal troubles and unfair practices. Regularly inform yourself of the methods available to challenge inaccuracies and fraudulent reporting, giving you the tools needed to navigate adverse credit reporting situations as they arise.

Key Takeaways

- Understanding your credit report and the impact of paid collections is key to improving your creditworthiness.

- Utilizing effective strategies such as negotiating with creditors and filing disputes for inaccuracies can help remove negative items.

- Building positive credit behaviors post-removal can sustain long-term improvements to your credit history.

- Continuous education on your consumer rights empowers you during negotiation and dispute processes.

FAQ

1. How long do collections stay on my credit report?

Generally, collections can stay on your credit report for up to seven years from the date of the original missed payment. However, once paid, they may positively impact your credit profile by indicating your commitment to resolving debts. Always inquire about potential timelines for removal when discussing with creditors.

2. Can I remove collections before seven years?

Yes, you can potentially delete collections from your credit report before the seven-year period under certain circumstances. This could involve proving inaccuracies in the reported information or negotiating with creditors through a pay-for-delete agreement. Be sure to keep thorough documentation when pursuing this route.

3. What should I do if my credit report contains inaccuracies?

If you spot inaccuracies in your credit report, device a structured letter to dispute the errors with credit bureaus promptly. Use evidence and documents as proof to support your claims, and track the progress of your disputes to ensure resolution.

4. Is professional credit repair legal?

Yes, professional credit repair services operate within legal consumer credit laws. However, selecting reputable services is crucial, as there are risks with scams in the industry. Research providers thoroughly and inquire about their practices before proceeding.

5. How often should I check my credit report?

It’s recommended to check your credit report at least once a year. However, with services allowing for free checks more often, staying updated could benefit you in understanding shifts in your credit profile and making necessary adjustments.

6. How do late payments affect collections?

Late payments can lead to collections when debts remain unpaid for extended periods. If an account goes to collections, it can significantly drag down your credit score. Staying on top of bill payments is essential to avoid becoming a victim of collection agencies.

7. What are my legal rights concerning collections?

You have several legal rights under the Fair Debt Collection Practices Act (FDCPA). For instance, collectors cannot harass you or report incorrect information. Knowing these rights can empower you to handle disputes effectively and result in improved credit scores.