“`html

Effective Ways to Find Growth Rate in 2025

Finding the growth rate is essential for businesses and investors looking to achieve optimal results in today’s dynamic market. Understanding how to calculate growth rate involves mastering various formulas, including the growth rate formula and interpreting percentages effectively. This article will dive into several methods to analyze and forecast growth rates thoroughly, offering actionable insights to enhance your decision-making process.

Understanding Growth Rate Metrics

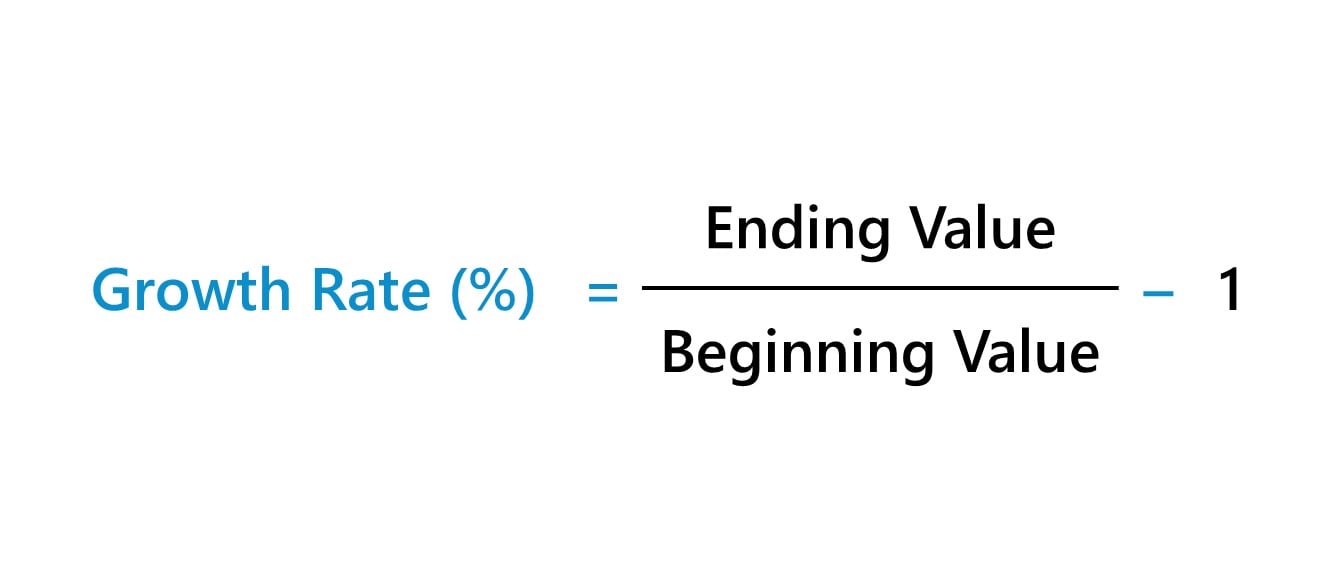

The growth rate percentage enables businesses to measure their performance over time. In finance, metrics such as annual growth rate and compound growth rate help assess how well investments are blooming. To calculate these rates, it’s pivotal to use the correct growth rate equation. The formula typically takes numerous forms yet revolves around the principle of taking the current value, subtracting the past value, and dividing by the past value, multiplied by 100 to yield a percentage.

Annual Growth Rate vs. Compound Annual Growth Rate

The distinction between annual growth rate and compound annual growth rate (CAGR) is crucial for long-term financial planning. The former captures growth over a single year, while CAGR shows the mean annual growth rate over a period. It is calculative by taking the ending value of an investment and dividing it by the beginning value, raised to the power of one divided by the number of years, minus one. This more advanced growth analysis allows for a clearer understanding of sustained growth trends amidst variances yearly. For example, if an investment grows from $1,000 to $1,500 over three years, its CAGR would reflect a steadier trajectory than just simple annualized returns which can fluctuate.

Factors Affecting Growth Rate

Several factors can influence the growth rate, from economic conditions to market demand. On a macroeconomic level, the economic growth rate influences how sectors perform, depending on GDP trends and external fuels for growth such as technology adoption. Conversely, for businesses, internal factors, like operational efficiency and customer satisfaction, drive the business growth rate. Identifying these drivers is pivotal for comprehensive growth analysis; tactics that yield favorable outcomes involve enhancing productivity, reaching new market segments, or diversifying product lines. Thus, understanding these dynamics ensures sound decisions are made backed by substantial data.

Strategic Methods to Calculate Growth Rates

Exploring effective methods to calculate growth rate assists investors and businesses in maximizing their returns. Familiarizing oneself with different formulas and corresponding contexts can yield valuable insights. Popular methods include direct comparisons across a predefined timeline to unveil patterns visible in the historical growth rate and resources to compute these within diverse domains such as finance, marketing, and operations.

Revenue Growth Rate Development

The revenue growth rate is instrumental for startups and established companies alike. By comparing revenue year-over-year, businesses can discern their performance trajectory. Suppose a business generated $100,000 in 2023 and $120,000 in 2024. The revenue growth rate calculation would be derived from the formula: ($120,000 – $100,000) / $100,000 = 0.2 or 20%. This figure can be subject to analysis through strategies like revenue projection templates or through industry benchmarks that ascertain where companies stand in relation to competitors.

Impact of Investment Strategies on Growth Rate

Investment growth rate hinges on multiple decision factors, including risk tolerance, market volatility, and investment horizon. The growth rate of investment typically correlates with projected outcomes analyzed through historic patterns. For instance, investments in tech stocks historically demonstrate high growth prospects but come with claims of steep volatility. Employing analysis tools can help outline your growth strategy perfectly, aligning it with possible risks and returns.

Utilizing Data for Growth Rate Analysis

Data analysis tools play a crucial role in understanding growth patterns and project future advancements. Growth rate analysis necessitates a data-driven approach, employing methodologies such as trend analysis, cohort analysis, and regression forecasting. Utilizing analytics dashboards or business intelligence platforms offers businesses unparalleled insight into how their strategies are playing out both in the long term and the short term.

Growth Trend Analysis Techniques

Growth trend analysis allows companies to track performance metrics over time and predict where they are headed. An effective way to visualize this is through graphs plotted against time – offering a clear representation of growth trajectories. Tools like forecasting systems and historical data evaluations stand at the forefront of developing reliable projections that steer decisions effectively towards optimal growth strategies. Strategies implemented upon gathered insights lay suitable groundwork for targeted interventions.

Forecasting Growth Rate: Tools and Techniques

To successfully predict future growth, contextual elements often derived from growth rate forecasting tend to invoke various models. Combining statistical methods with contemporary data can yield enriched insights. Machine learning frameworks can also facilitate refined predictions by reviewing vast datasets to identify bottlenecks or new efficiencies. Resources such as Kaggle or Hubspot provide guides for implementing advanced metrics while ensuring businesses stay approachable regarding accessible forecasting economics.

Key Takeaways

- Understanding and calculating growth rates is crucial for business and investment decision-making.

- Different methodologies, including CAGR and revenue growth rate, provide various insights.

- With a clear understanding of factors affecting growth rates, organizations can implement strategies to optimize performance.

- Leveraging data analytics can enhance growth forecasting and strategic planning.

FAQ

1. What is the meaning of growth rate in finance?

Growth rate refers to the measure of the increase in value over time in financial terms, showcasing performance metrics. It assesses how well an asset or investment grows relative to its initial value.

2. How can one measure growth effectively?

To measure growth effectively, one can implement various tools and methodologies such as comparing revenue figures, utilizing CAGR, and analyzing trendlines through advanced analytics that capture both short-term and long-term shifts.

3. How do economic indicators relate to growth rates?

Economic indicators provide fundamental data that influences growth rates by measuring factors like employment rates, average salaries, GDP growth, and market performance. Understanding these indicators allows businesses to forecast effectively.

4. What are common growth rate calculations used across industries?

Common calculations embraced include annual growth rate, revenue growth rates, ROI percentages, and CAGR, all offering different perspectives on financial performance depending on the industry context.

5. Why is growth analysis important?(using underutilized keyword)

Growth analysis is crucial as it informs businesses of their performance trajectory, identifies trends, and highlights areas requiring attention, thus enabling stakeholders to make informed decisions regarding future strategies.

“`