Best 5 Options for Filing Chapter 7 Costs in 2025: Understanding Fees and Expenses

Filing for chapter 7 bankruptcy is a significant financial decision and understanding the related costs is essential. In this article, we will explore the cost to file chapter 7 in 2025, including key expenses, attorney fees, and various filing strategies. We aim to provide clarity on chapter 7 bankruptcy fees, allowing individuals to make informed decisions regarding their financial futures.

Understanding Chapter 7 Bankruptcy Fees

The chapter 7 bankruptcy process involves several fees and expenses that can vary by location and individual circumstances. Typically, these includes court fees, legal assistance, and other filing costs that may arise during the process. The total cost of chapter 7 can be affected by several factors including legal representation, the complexity of the case, and any additional requirements mandated by the court.

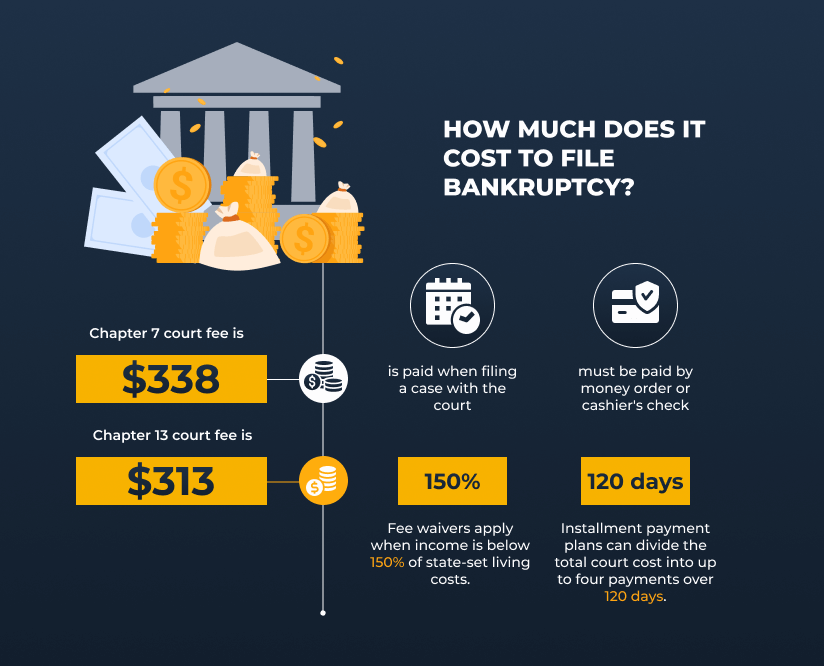

Initial Filing Fees and Costs

The first step in understanding chapter 7 costs is recognizing the initial filing fees. In 2025, the filing fees for chapter 7 are expected to remain consistent, averaging around $335. This chapter 7 application fee is paid at the beginning of the bankruptcy process. Furthermore, additional fees might also arise depending on the jurisdiction and any extra filing requirements as stipulated by the court. Ensuring that all necessary documents are properly prepared can mitigate unexpected costs down the line.

Attorney Fees for Chapter 7

Securing legal representation is often a vital part of filing for chapter 7 bankruptcy. Attorney fees for chapter 7 can vary significantly, depending on the attorney’s experience, the region, and the complexity of the case. Typically, these costs range from $1,000 to $3,500. Some attorneys may charge a flat fee for chapter 7, which allows clients to have a clear understanding of their financial commitments right from the start. Consulting with a bankruptcy attorney can clarify costs upfront and help in understanding the potential financial obligations throughout the process.

Hidden Expenses in Chapter 7 Bankruptcy

Beyond the initial legal and court fees, individuals must be aware of other possible expenses involved in the bankruptcy process. Costs such as credit counseling sessions, required court documents, and lifestyle adjustments may arise. For example, bankruptcy filing costs explained can include charges for any required legal documents, which can vary by state and circumstance. It’s also beneficial to set aside funds to cover these costs to avoid complications during your bankruptcy timeline.

Chapter 7 Legal Assistance and Costs Analysis

When pursuing chapter 7 bankruptcy, legal assistance typically plays a crucial role in navigating the complex court procedures. Identifying the bankruptcy attorney costs involved is essential for budget planning. These costs can vary significantly based on multiple influencing factors, from the legal market in your area to the attorney’s billing method.

Choosing Between Attorney Representation and Self-Filing

A growing number of individuals consider the option of filing chapter 7 without a lawyer, primarily to save on expenses. While this may seem appealing, it’s essential to approach this route cautiously. Undertaking bankruptcy without professional help can lead to oversights and mistakes in the paperwork. It’s advisable to carefully evaluate personal financial situations before making this choice, weighing potential savings against the risks involved in improper filings or missteps during the court process.

Comprehensive Cost Breakdown

An essential element of understanding chapter 7 bankruptcy filing price lies in creating a thorough cost breakdown. When calculating both expected and hidden expenses, it is crucial to include all potential chapter 7 filing expenses throughout the process. For example, credit counseling costs can add approximately $50-$100 to the overall bill, while any follow-up court appearances could have their associated costs as well. Hence, presenting a detailed outline of both fixed and variable expenses can aid individuals in their financial planning.

Finding Affordable Legal Representation

Finding an affordable attorney who specializes in chapter 7 bankruptcy can drastically affect the overall costs. In 2025, individuals are encouraged to seek out assistance through local legal aid organizations, or even community services that provide low-cost representation. Understanding the chapter 7 bankruptcy attorney rates can also be achieved by comparing quotes from various practitioners to ensure that you are receiving a fair price paired with quality service.

Impact of Filing Chapter 7 on Financial Future

Filing for chapter 7 bankruptcy not only comes with immediate costs but also demonstrates significant implications for one’s financial future. Understanding the potential consequences can assist individuals in making responsible decisions regarding their finances.

Rebuilding Credit After Bankruptcy

Chapter 7’s impact on credit is a common concern for those considering bankruptcy. Typically, personal credit scores can decline significantly after filing, usually ranging between 130 to 240 points, depending on the individual’s prior credit score. Many individuals experience financial strain during the transition post-bankruptcy, making it essential to adopt effective financial planning strategies, such as establishing secured credit cards or small loans to begin rebuilding credit.

Financial Recovery Strategies

To best manage future finances after bankruptcy, individuals are encouraged to employ financial recovery strategies which can ease the transitional phase. Building and sticking to a clear budget, exploring credit education programs, and timely bill payments are all practical steps toward achieving financial stability. Creating an actionable plan not only prevents reverting to previous financial dilemmas but also lays the groundwork for long-term recovery and growth.

Educational Costs Related to Bankruptcy

Understanding the intricacies of the bankruptcy process can also lead to related educational expenses. Programs or workshops focusing on financial literacy and management for individuals who have filed can be beneficial. Such resources have varying costs and can ultimately aid in better managing finances post-bankruptcy while emphasizing responsible behavior moving forward and avoiding pitfalls previously encountered.

Conclusion: Empowering Your Financial Future

The cost of filing chapter 7 is a complex subject imbued with various individuals and legal contexts. Understanding the potential fees associated with bankruptcy, as well as the path forward during and after filing, equips individuals to take the necessary steps toward financial recovery. By engaging with knowledgeable legal practitioners and leveraging available resources, individuals can make informed choices that lead to greater financial happiness beyond the bankruptcy process.

FAQ

1. What are the typical costs for chapter 7 bankruptcy?

The *average cost to file chapter 7* can fluctuate, but it generally ranges between $2,000 and $3,500, which includes attorney fees, court costs, and additional expenses associated throughout the filing process.

2. Are there any waivers available for filing fees?

Yes, individuals who meet certain income thresholds may qualify for a fee waiver or a payment plan to assist with the *chapter 7 court costs*. This can significantly alleviate upfront financial burdens when filing for bankruptcy.

3. How does attorney representation impact chapter 7 costs?

Having legal representation can increase the overall *chapter 7 bankruptcy filing expenses*, but it often results in more competent project management of the filing process, potentially avoiding costly errors or additional court appearances that can further drive up costs.

4. Can I file chapter 7 bankruptcy and keep my property?

Yes, several *chapter 7 bankruptcy exemptions* allow individuals to retain certain assets under specific conditions. However, the nuances vary by state, so it’s crucial to consult with an attorney to understand what can be protected.

5. Does filing chapter 7 eliminate my debt entirely?

While chapter 7 bankruptcy helps eliminate many unsecured debts, it does not discharge certain obligations such as student loans, child support, or tax debts, meaning it’s vital to determine which *financial obligations* might remain post-bankruptcy.